Browse Books

Browse Books

- Accounting

- Finance

- Human Resources

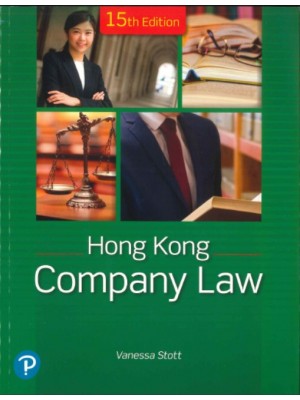

- Law

- Administrative / Constitutional Law

- Antitrust / Competition Law

- Arbitration / Mediation / Litigation

- Art Law

- Banking / Finance

- Bankruptcy / Insolvency

- Biography

- Business / Commercial Law

- Charities

- Civil Procedure

- Commercial Fraud

- Common Law Library

- Company Law

- Company Secretarial

- Comparative Law

- Conflict of Laws

- Construction / Building Law

- Consumer Law

- Contract Law

- Conveyancing / Tenancy / Land

- Corporate Governance

- Criminal Law

- Discrimination Law

- Ecclesiastical Law

- Education Law

- Employment / Labour Law

- Environmental / Energy Law

- Equity & Trusts

- European Union Law

- Evidence

- Family Law

- Food Law

- Health & Safety

- Human Rights

- Immigration

- Information Technology Law

- Insurance Law

- Intellectual Property / Patent / Copyright

- International Law

- Islamic Law

- Law Dictionary

- Legal History

- Legal Profession

- Media / Entertainment Law

- Medical Law

- Mental Health Law

- Mergers & Acquisitions

- Money Laundering

- Others

- Planning Law

- Police / Public Order Law

- Reference Resources

- Restitution

- Securities

- Social Security & Welfare Law

- Sports Law

- Tort / Personal Injury

- Taxation

- Study Materials

- AAT Papers

- ACCA Series (BPP)

- ACCA Series (Kaplan)

- AHKIB Exam

- Bar Manual Series

- CLP Law Series

- Complete Law Series

- Concentrate Law Series

- Course Notes Law Series

- CPA Australia Series

- CPA Exam

- Foundations in Accountancy (FIA)

- Great Debate in Law Series

- Key Facts/Cases Law Series

- Law Cards Series

- Law Express Series

- Law in Context Series

- LPC Law Series

- Master Guides (HKCA)

- Wolters Kluwer Online Resources

- Tax & Accounting Practical Toolkit