-

Details

- Take the Smart approach - the integrated case study at the heart of the book brings accounting to life, engaging students and clearly demonstrating the relevance of accounting in a business context.

New to this edition

- New coverage of corporate governance, ethics, and sustainability informs students of the topical issues surrounding accountancy for business, such as environmental responsibility.

- End of chapter questions include true or false questions, practice questions, and advanced questions, giving students ample options for testing their knowledge.

- Updated end of part case studies complement the Smart case study, providing examples of accountancy in practice.

- A greater range of further reading enables students to enhance their knowledge of the subject, pointing them to professional journals and academic articles.

- Two additional chapters online introduce readers to the basic principles of double-entry bookkeeping from a non accounting perspective.

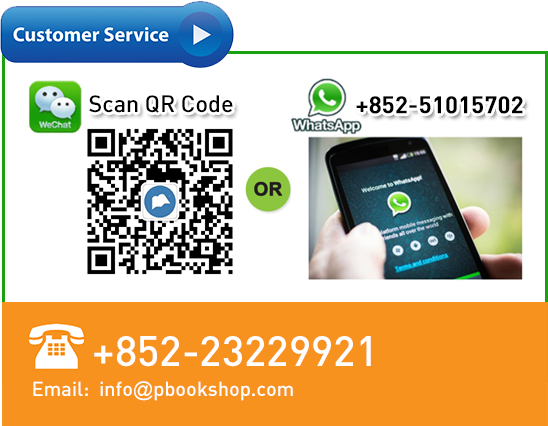

- QR codes integrating the wealth of online materials and activities with the print chapters

Engaging and lively, clear and practical, Accounting: a Smart Approach 2e brings accounting to life for both lecturers and students. Developed specifically with non-specialist students in mind, it addresses key questions that students might have:

Why is accounting relevant to business?

How does accounting help managers to understand and develop their businesses?

How will studying accounting help me after my course?

Following the global success of the first edition, Accounting: A Smart Approach 2e continues this fresh and effective approach to accounting for non-specialists, using a running case study to help students to understand the relevance of accounting alongside their wider studies:

Sam Smart is the budding entrepreneur who forms the basis of the case study at the heart of this book. We follow Sam as he goes from starting as a sole trader , printing sports kits for local teams, to managing a global sports business. Throughout the course of the book he assesses the success of his business, finances day to day activities, makes pricing decisions, opens new branches, looks at cash flow, and facilitates planning, control, and investment. Featuring at the start of every chapter, directing students to the implications and applications of the the topic they are about to study, Sam and his business provide consistency and connection.

As we follow the case study, all the topics central to accounting are covered with clarity, imagination and relevance, giving students confidence in approaching their course and exams. Through the wealth of additional examples and self-test exercises available alongside the case study, students will not only develop an appreciation of how accounting information allows a manager to make key business decisions, but they will also acquire the skills necessary to enable them to converse with accountants, and challenge their assumptions and methodologies.

Through the provision of integrated PowerPoint slides, a comprehensive test bank of questions and a detailed assessment guide, lecturers are provided with an invaluable package of support, which is vital when teaching large student cohorts.

Readership: Business students taking an introductory module in accounting. Also students on degree programmes such as engineering, computing, and hospitality management taking an optional accounting module. There may also be a market at some institutions where accounting students are taught alongside business students on common first year programmes.

-

Part One: Financial Accounting

1.: The Cash Budget

2.: Introduction to the Income Statement or Statement of Profit or Loss

3.: Balancing the Basics

4.: Accounting for Depreciation and Bad Debts

5.: Company Finance

6.: Company Accounts

7.: The Statement of Cash Flows

8.: Interpreting Financial Statements

9.: Capital Structure and Investment Ratios

Part Two: Management Accounting

10.: Costs and Break-even Analysis

11.: Absorption and Activity-based Costing

12.: Budgeting

13.: Pricing and Costs

14.: Short-term Decision Making

15.: Investment Appraisal Techniques

16.: Performance Measurement

-

Mary Carey was formerly a senior lecturer at Oxford Brookes University, lecturing in financial accounting and taxation and has a great deal of experience in delivering accounting courses for non-accounting students. She originally trained as a chartered accountant with Grant Thornton, London. Mary currently acts as an advisor for the Citizens Advice Bureau.

Cathy Knowles is a senior lecturer at Oxford Brookes University in the Department of Accounting, Finance and Economics. She trained as a chartered management accountant with Unilever plc in London. She has held various management accounting posts with Marks and Spencer plc and H J Heinz Ltd, where she became Financial Controller for New Business Development. She lectures in management accounting and is currently undertaking a PhD at the University of Bristol.

Jane Towers-Clark is programme director of the BSc in Applied Accounting programme at Oxford Brookes University having acted as Head of Department for Accounting, Finance and Economics during 2012. Jane trained as a chartered accountant with Ernst and Young in London, going on to work in Singapore and Australia as a lecturer and auditor before returning to the UK. Jane obtained her Diploma in Education in 2007 and is currently working on her Doctorate in Education with the Institute of Education.

-

"This book is very well written and topics are easy to understand, especially for non-accounting students. " -Atish Soonucksing, Tutor in Accounting and Finance, University of Surrey

"This intelligently written book makes accounting relevant to business students. The authors expertly weave together the engaging running case study with clear explanation and a wealth of opportunities for students to test their understanding. This is the perfect companion for all business studies students taking their first accounting module. " - Eva Wittbom, Assistant Professor, Stockholm University

"Students find the running case study interesting and relate readily to it. " - Mark Jackson, Lecturer, University of Technology, Jamaica

"The idea behind this book is unique and so relevant to students, making accounting come alive as we imagine ourselves in business. " - Sarah Bamidele, Student, University of Durham

"This text book made my studies much easier by simplifying accounting; I wish more university level books could help students so effectively. Thank you Accounting: A Smart Approach for helping me to succeed in my studies and my exams! " - Ifrah Salah Bulale, Student, Stockholm University